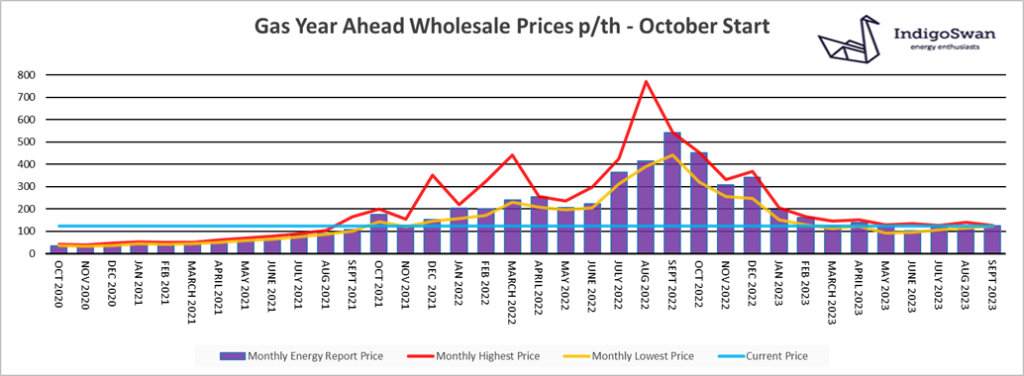

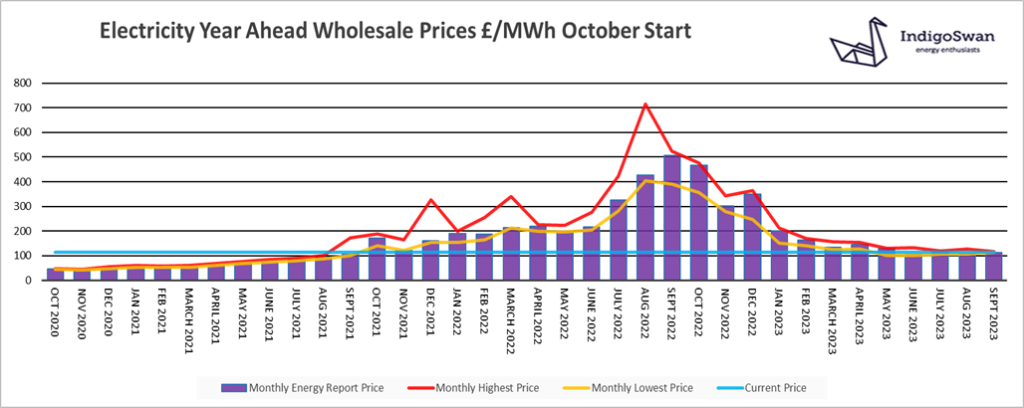

As of the 4th of September, Gas and Electricity Year Ahead Wholesale costs were higher when compared to last month’s report.

EU Gas Storage levels have now passed the 90% full target for November, currently at 93% compared to 85% last month and 80% in 2022, when there was concern that there may be Gas shortages during the winter, which caused much of the price volatility. The level of confidence in Gas supplies for winter 2023/24 remains a significant influence on prices. Any indications of extended periods of below average temperatures or Gas supply disruptions, including those piped through Ukraine, will add pressure to costs. This was seen in August after initial reports that there may be industrial action by LNG workers in Australia, and the subsequent confirmation that strikes will take place on the 7th of September and from the 14th of September. Talks are ongoing to try to avoid.

Gas remains the main source of generation, despite the growing diversity of Electricity supplies, which includes renewables and connections to the continent. However, due to the lack of reliability of Wind and Solar, and not currently being able to store Electricity on any great scale, Gas generation continues to dictate the power price.

The Met Office forecast for September suggests temperatures are likely to be above seasonal norm.

The Energy Bills Discount Scheme (EBDS) replaced the Energy Bill Relief Scheme (EBRS) on the 1st of April 2023. It is designed to give all non-domestic customers, including the voluntary sector (such as charities) and the public sector (such as schools and hospitals) access to a phased in maximum discount when the customer’s wholesale cost exceeds the defined thresholds. This scheme lasts for 12 months until 31st of March 2024 and applies to contracts that were put in place on or after 1st of December 2021 and non-contracted arrangements. As with the EBRS, energy suppliers will automatically apply these standard discounts. The levels of assistance are less generous, but the price of Gas and Electricity is considerably lower than 2022. Those companies that are classed as Energy and Trade Intensive Industries (ETII) and Heat Networks, had to apply in July 2023 to receive a more attractive discount.

Customers may have started to see higher Standing Charges on their Electricity invoices from 1st of April 2023. There have been changes to the way some industry charges are calculated, under the Targeted Charging Review. This move is part of an attempt to recover more Electricity costs, such as Transmission and Balancing, through fixed fees. In theory this should give both the customer and the industry a more accurate way of managing finances.

Indigo Swan are working closely with energy suppliers to help all our customers understand and manage these changes.

Please contact us on 0333 320 0475 to discuss options or to get a latest update.

On the 4th of September, the Gas Year Ahead Wholesale cost was 124.13p/th, up from 115.47p/th in last month’s report and 77% less than 2022.

It has been announced that Australian LNG workers will strike on the 7th of September and from the 14th of September, due to pay and working conditions. The facilities account for an estimated 5-7% of global LNG supplies and action could see demand increase from the likes of the US and Qatar. The high levels of EU Gas Storage, at 93% full against a November target of 90%, has meant that the impact of the potential strikes is less than would be expected.

Although recent price movements have been far less volatile than we saw in 2022, we are still seeing some significant daily swings in reaction to a range of issues, which are impacting on customer’s budgets. Any global events thought to reduce Gas supplies or increase demand, will have an exaggerated effect. It is currently being assumed that we will have seasonal normal temperatures this coming winter and that there will be no interruptions to imports into Europe or unplanned closures of infrastructure. The Groningen Gas field is closing by the 1st of October 2023, earlier than expected due to safety concerns. The Dutch government has said it could be utilised for one more year in the event of a Gas supply emergency.

Energy suppliers are now offering a wider range of contracts so we would advise discussing your options for contracts ending in 2023 or early 2024 with Indigo Swan, for both one and two years.

On the 4th of September, the Electricity Year Ahead Wholesale cost was £113.21/MWh, up from £107.98/MWh in last month’s report and 78% less than 2022.

Electricity demand in August continued the trend of being less than recent years and roughly 9% lower than 2022. This is partly due to the cooler temperatures and less air conditioning, although this would also mean a reduced Solar contribution. It is also likely that the lower energy use is due to the need to reduce carbon emissions and a forced change in habits as a way of avoiding some of the impact of high Gas and Electricity costs.

Wind’s contribution to generation fell from 24% in July to 20% in August, so we were more reliant on expensive Gas, which increased to 38%. Electricity Imports from Europe were up from 12% to 13% and remain an important but not always reliable part of our energy supply mix.

The National Grid has mechanisms in place to help avoid power shortages and has taken additional steps to secure generation on demand. This will mean the likely use of Coal and the Demand Flexibility Service, which incentivises customers to reduce demand at peak times. These measures do come at a cost, in the form of higher third-party charges within bills but provide an element of stability to prices which otherwise may react even more dramatically.

Let us know if you would like us to research your options for one and two years, for contracts ending in 2023 or early 2024.

If you enjoyed reading this blog why not try one of our others:

"Indigo Swan were professional but with a personable approach. Their market knowledge allowed me to enter new contracts with confidence, this was something I was unable to do with my previous broker."

Joanna Thornton, Estate Manager

"The experience behind the Indigo Swan team, their passion and integrity were all important to us. They clearly understood the market and could provide the best advice. "

Phil Riseborough, Head of Facilities

"We’ve worked with other energy consultants, but with Indigo Swan we get real integrity and service that is way beyond our expectations. We have already saved over £120k."

Jason Wakefield, Procurement Manager

| Cookie | Duration | Description |

|---|---|---|

| TawkConnectionTime | session | Tawk.to, a live chat functionality, sets this cookie. For improved service, this cookie helps remember users so that previous chats can be linked together. |

| Cookie | Duration | Description |

|---|---|---|

| SRM_B | 1 year 24 days | Used by Microsoft Advertising as a unique ID for visitors. |

| Cookie | Duration | Description |

|---|---|---|

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| MR | 7 days | This cookie, set by Bing, is used to collect user information for analytics purposes. |

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_gtag_UA_12371872_1 | 1 minute | Set by Google to distinguish users. |

| _ga_* | 1 year 1 month 4 days | Google Analytics sets this cookie to store and count page views. |

| _gcl_au | 3 months | Provided by Google Tag Manager to experiment advertisement efficiency of websites using their services. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| Cookie | Duration | Description |

|---|---|---|

| ANONCHK | 10 minutes | The ANONCHK cookie, set by Bing, is used to store a user's session ID and also verify the clicks from ads on the Bing search engine. The cookie helps in reporting and personalization as well. |

| MUID | 1 year 24 days | Bing sets this cookie to recognize unique web browsers visiting Microsoft sites. This cookie is used for advertising, site analytics, and other operations. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| Cookie | Duration | Description |

|---|---|---|

| CLID | 1 year | No description |

| SM | session | No description available. |

| twk_idm_key | session | No description |

| _clck | 1 year | No description |

| _clsk | 1 day | No description |