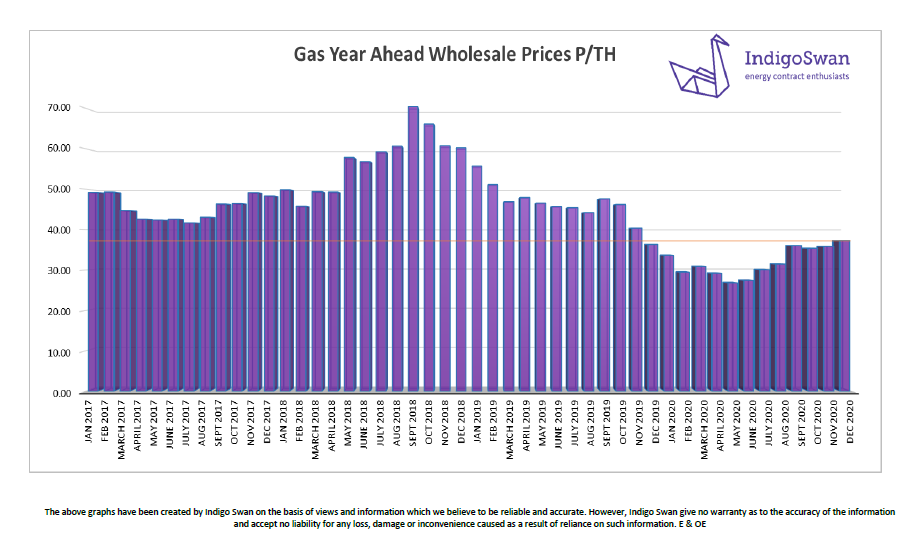

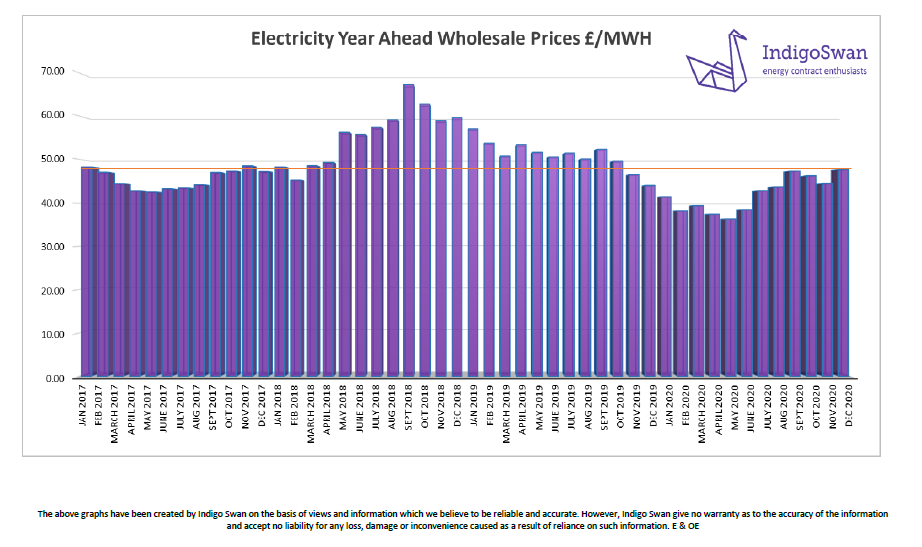

As of the 7th December, Gas and Electricity Year Ahead Wholesale costs are higher, when compared to last month’s report.

The price of Oil has steadily increased over the last month, from $39 to $49 a barrel, the highest since March 2020. The announcements of successful vaccine trials boosted prices, providing more optimism for an economic recovery and a greater need for Oil. OPEC+, which includes Saudi Arabia and Russia, have agreed to increase production from January 2021 by a modest amount but will hold monthly reviews.

The colder temperatures, a greater heating demand and the need for a 56% contribution to Electricity generation over two consecutive days, pressured Gas Wholesales prices higher.

In November there were points of concern if the Electricity generation available could meet the demand, without further intervention. Wind’s contribution fell to just 2% on the 26th November, from a month high of 36%. On this occasion, expensive Coal met almost 5% with the remaining shortfall coming from Gas. Coal power stations are due to close by 2025.

The Met Office forecast for the next month suggests mostly average temperatures but with colder nights, requiring additional heating demand. High winds are expected at times, mostly in the north, supporting generation.

Wholesale prices are high when compared to the rest of 2020 but show good value when looking back at recent years. It should be remembered that this element makes up in the region of just 40% of the total cost of an Electricity bill and roughly 60% for Gas.

Increasing third-party costs are noticeable in Electricity contracts. These include, Transportation, Distribution, and government policy levies. The levies help balance supply and demand.

Over the next few years, the way some of these charges are calculated will change, under the Targeted Charging Review, full details are not yet available. Initially the first change to Transportation costs was due April 2021, but with delays issuing price guidelines to energy suppliers, this has been postponed until April 2022. The planned change to Distribution charges is still set for April 2022. This does mean that the expected opening of some fixed priced contracts should not take place until 2022.

We advise closing any remaining 2020 contracts and requesting supplier offers for early 2021 starts to compare against your current prices. Be aware that suppliers have tightened their credit requirements and reduced their risk appetite, although this will hopefully ease as we saw after the previous lockdown. Good forward contract options can still be negotiated, especially for longer term contracts.

Please contact us on 0333 320 0475 to discuss options or to get a latest update.

On the 7th December, the Gas Year Ahead Wholesale cost was 37.27 (p/th), from 35.85 (p/th) in last month’s report and 3% higher than 2019.

Gas demand in November 2020 was lower than 2019, although we continue to be heavily reliant on it for Electricity generation, increasing to 38%, but peaking at 56% on the 26th and 27th. This generation demand and the additional heating requirements from a cold spell, contributed to the higher Gas price.

Despite a high global LNG demand and rising prices, we have received more deliveries. These along with the good levels of Gas Storage both here and in Europe, provide greater confidence and price stability.

Although we have seen lower temperatures, we still await a very cold spell, which typically has an immediate but short-term impact on Gas, and a knock-on effect for Electricity.

Let us know if you would like us to research your options for 12, 24 and 36 month contracts.

On the 7th December, the Electricity Year Ahead Wholesale cost was 47.68 (£/MWh), from 44.57 (£/MWh) in last month’s report and 8% higher than 2019.

Although combined Wind and Solar were lower in November, there was an increase when compared to 2019, at 22% from 17%. Gas generation met most of the demand and spikes, so with a higher Gas price, Electricity has followed. Overall demand was lower than November 2019.

More expensive Coal generation was required for most of November and so far in December, to help meet an increased demand and make up the shortfalls from low levels of Renewables.

The industry remains confident that it can cope with changing demand patterns. National Grid has issued warnings of potential issues and uses the mechanisms in place to secure generation or reduce demand. Although these mechanisms do come at a cost, in the form of higher third-party charges within Electricity bills, they do provide an element of stability to prices which otherwise may react with far more volatility.

Let us know if you would like us to research your options for 12, 24 and 36 month contracts.

"Indigo Swan were professional but with a personable approach. Their market knowledge allowed me to enter new contracts with confidence, this was something I was unable to do with my previous broker."

Joanna Thornton, Estate Manager

"The experience behind the Indigo Swan team, their passion and integrity were all important to us. They clearly understood the market and could provide the best advice. "

Phil Riseborough, Head of Facilities

"We’ve worked with other energy consultants, but with Indigo Swan we get real integrity and service that is way beyond our expectations. We have already saved over £120k."

Jason Wakefield, Procurement Manager

| Cookie | Duration | Description |

|---|---|---|

| TawkConnectionTime | session | Tawk.to, a live chat functionality, sets this cookie. For improved service, this cookie helps remember users so that previous chats can be linked together. |

| Cookie | Duration | Description |

|---|---|---|

| SRM_B | 1 year 24 days | Used by Microsoft Advertising as a unique ID for visitors. |

| Cookie | Duration | Description |

|---|---|---|

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| MR | 7 days | This cookie, set by Bing, is used to collect user information for analytics purposes. |

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_gtag_UA_12371872_1 | 1 minute | Set by Google to distinguish users. |

| _ga_* | 1 year 1 month 4 days | Google Analytics sets this cookie to store and count page views. |

| _gcl_au | 3 months | Provided by Google Tag Manager to experiment advertisement efficiency of websites using their services. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| Cookie | Duration | Description |

|---|---|---|

| ANONCHK | 10 minutes | The ANONCHK cookie, set by Bing, is used to store a user's session ID and also verify the clicks from ads on the Bing search engine. The cookie helps in reporting and personalization as well. |

| MUID | 1 year 24 days | Bing sets this cookie to recognize unique web browsers visiting Microsoft sites. This cookie is used for advertising, site analytics, and other operations. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| Cookie | Duration | Description |

|---|---|---|

| CLID | 1 year | No description |

| SM | session | No description available. |

| twk_idm_key | session | No description |

| _clck | 1 year | No description |

| _clsk | 1 day | No description |